Hello. Welcome to the latest edition of the FT Crypto Finance Newsletter. This week, we look at the possibility of a new crypto arms race.

Singapore has given blockchain company Paxos the green light in principle to issue stablecoins, a type of cryptographic token pegged to hard currency.

The company plans to launch the cryptocurrency through a new legal entity in Singapore. It is pegged to the US dollar and fully backed 1:1 by US dollars and cash equivalents.

Those close to the cryptocurrency sector will remember Paxos as the issuer of BUSD, a Binance-branded stablecoin that has become largely irrelevant after falling foul of New York regulators earlier this year.

Nevertheless, Paxos’ approval comes after several high-profile projects in the city collapsed, including crypto hedge fund Three Arrows Capital and stablecoin operator Terraform Labs. It shows that the record has the potential to change one’s destiny.

Singapore’s state-backed investor Temasek was also forced to write off its $275 million stake in once-industry bellwether FTX following the famous financial exchange’s collapse a year ago. Temasek said its trust in former FTX chief executive Sam Bankman-Freed, who has now been convicted of fraud and other charges, appeared to have been “misplaced”.

Readers of this newsletter will know that the UK has already put stablecoin cards on the table and has guidelines regulating digital tokens to facilitate their use as payment options for everyday goods and services. There will be.

Therefore, Singapore’s new entry into the major digital asset market a week later is a sign that the international You might think that the tablecoin arms race is heating up. .

While it is tempting to suggest that U.S. action on cryptocurrencies opens the door for a boom in the crypto sector in other regions, the available data does not seem to support that claim.

There is little convincing evidence to suggest that there is demand for dollar-pegged stablecoins in Singapore, or even across Asia.

It is difficult to pinpoint the region in the world where interest in stablecoins is highest. Cryptocurrency traders often use virtual private networks (VPNs) to hide their locations from the prying eyes of regulators and governments that are unfriendly to crypto trading.

Interest in the market can still be measured by measuring the largest trading pairs between the world’s sovereign currencies and the largest stablecoins. For example, if one of the top fiat trading pairs for Tether, the world’s largest dollar-pegged token, is the Singapore dollar, traders in this city-state represent one of the most popular markets for stablecoins. It would be fair to guess.

However, according to figures provided by industry data platform CCData, the top five trading pairs for Tether’s USDT token are the US dollar and the euro, followed by the Turkish lira, Thai baht and British pound.

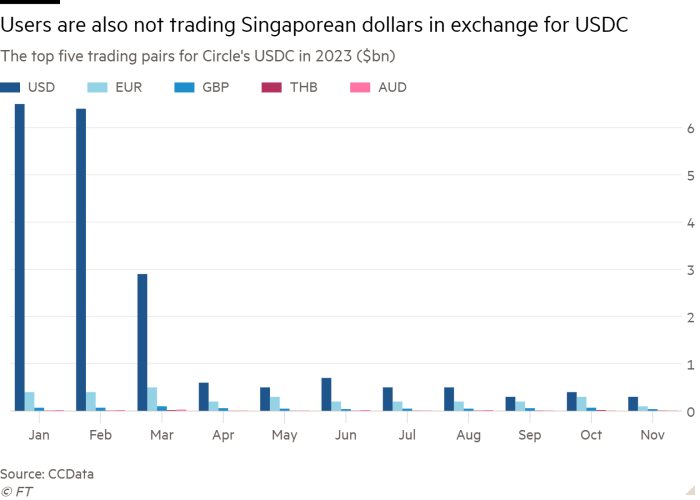

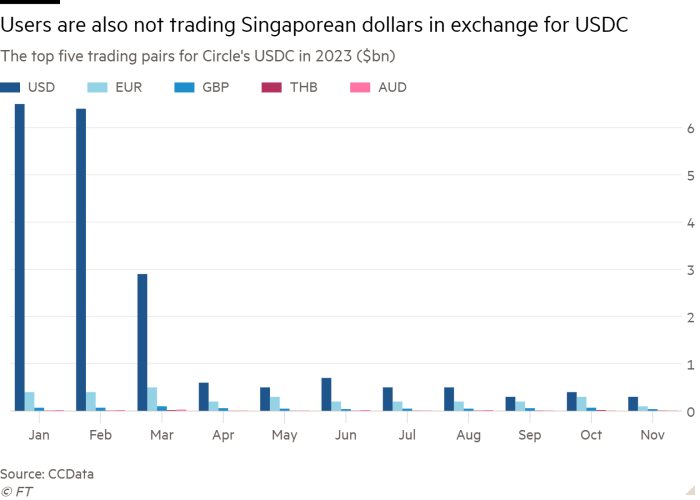

The outlook for Singapore’s stablecoin push does not improve by looking at the USDC stablecoin, which has around $24 billion in circulation in the market and is the second-largest token of its kind. As expected, the US dollar and euro led the way, followed in turn by the pound, baht and Australian dollar.

Other notable stablecoins include DAI (an algorithmic cryptocurrency much like the Terra token that failed in 2022) and BUSD. BUSD remains the fifth-largest stablecoin in the United States, despite hemorrhaging market share since its issuance was banned by the New York State Department of Financial Services. market.

These key trading pairs of tokens once again offer little encouragement for the city-state looking to reassert its grip on the crypto market. The Korean won, Brazilian real, and Mexican peso have all made notable entries into these tokens, but the Singapore dollar is nowhere to be seen.

Paxos head of strategy Walter Hessart said Paxos’ expansion into Singapore was underpinned by the company’s ambition to “open up the financial system to everyone, unlocking significant opportunities for global markets and billions of users.” It is said that there is

However, since its $188 billion peak in April last year, the stablecoin market capitalization has fallen by about 33 percent and now stands at $126 billion. So while Paxos is breaking new ground in Singapore, it’s doing so in a market it hasn’t expanded to.

What do you think about Singapore’s recent move towards cryptocurrencies? As always, drop us an email at scott.chipolina@ft.com.

Weekly highlights:

Rebuild or exit: These are the options left for the crypto industry after the fall of Sam Bankman Freed. There are some signs that the industry is ready to hit the ground running, including the possibility of an SEC-approved Bitcoin spot ETF. But zoom out and you’ll see an industry ravaged by scandal, a retail market that hasn’t returned, and crypto’s most ardent defenders calling for a “parallel creation.”

Crypto media group The Block announced this week that it is hiring venture capital firm Four, in a move to secure the news organization’s future after it was revealed that its former chief executive had taken a secret loan from Bankman Freed. Sold to Cyto Ventures. The Singapore-based investor has acquired a majority stake in The Block, with the company investing $56 million for 80%, according to a person familiar with the matter.

Remember Tornado Cash, the cryptocurrency platform that was sanctioned by the US for allegedly laundering $7 billion worth of crypto funds for North Korean hackers? appealed the U.S. Treasury Department’s decision to penalize the platform, challenging its jurisdiction. Yesha Yadav, a law professor at Vanderbilt University, said the appeal “reveals that there is a major crisis looming for decentralized finance.”

Soundbite of the week: US law fails to solve cryptocurrency crimes

At a Congressional hearing on illegal practices in the digital asset industry, Alison Jimenez, president of consulting firm Dynamic Securities Analytics, said US laws aimed at rolling back the cryptocurrency sector fail to protect consumers from bad actors in the sector. He said there is a possibility.

“U.S. law still does not change the fundamental functionality of cryptocurrencies. I worry that the U.S. has great regulations. If U.S. institutions follow them, that would be great. But US citizens and customers will still be victims of outside parties coming in. (Crypto) Currency is not going to stop being a useful tool for criminals.”

Data mining: The price of fake news continues to rise

BlackRock’s foray into the cryptocurrency space continued this week after the world’s largest asset manager filed with the SEC for a Spot Ethereum exchange-traded fund.

As a result, the price of Ether rose slightly, but a few weeks ago Bitcoin prices spiked on inaccurate reports that BlackRock’s application for another spot ETF linked to Bitcoin had been approved by the SEC. You may even remember that time.

This week, another fake application hit the crypto market, once again showing the speculative nature of the crypto market. This time it was against the iShares XRP Trust, which is registered in Delaware. A BlackRock representative told the FT that the company had not applied for an XRP trust, but the price of XRP briefly spiked nonetheless.

This week’s FT Cryptofinance is edited by Lawrence Fletcher. If you have any comments or feedback, please send them to cryptofinance@ft.com.