Prices rose in the first week of the year as CME’s open interest improved. Altcoins outperformed Bitcoin as the largest cryptocurrency remained range bound. Meanwhile, ETF flows remained net negative.

Bitcoin

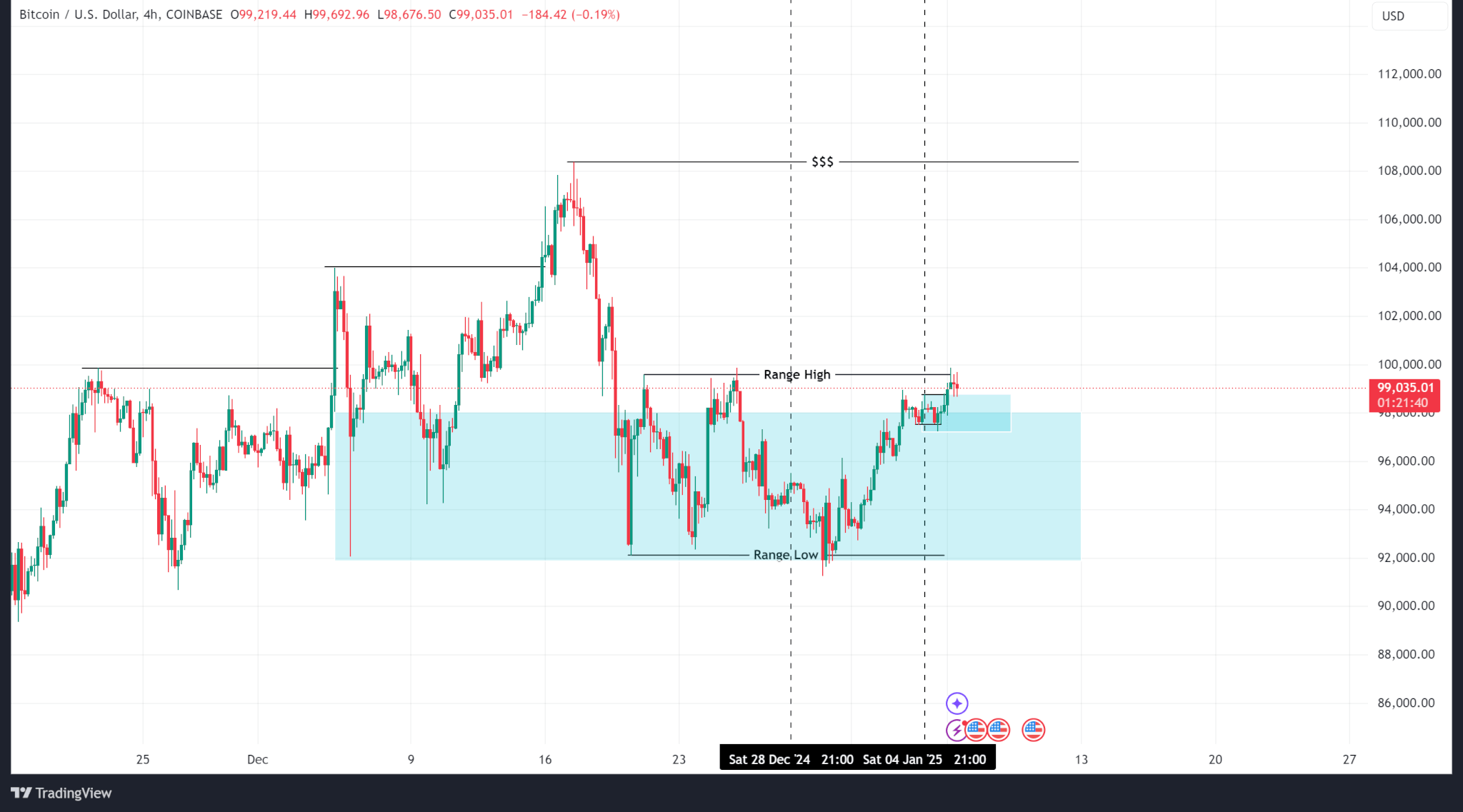

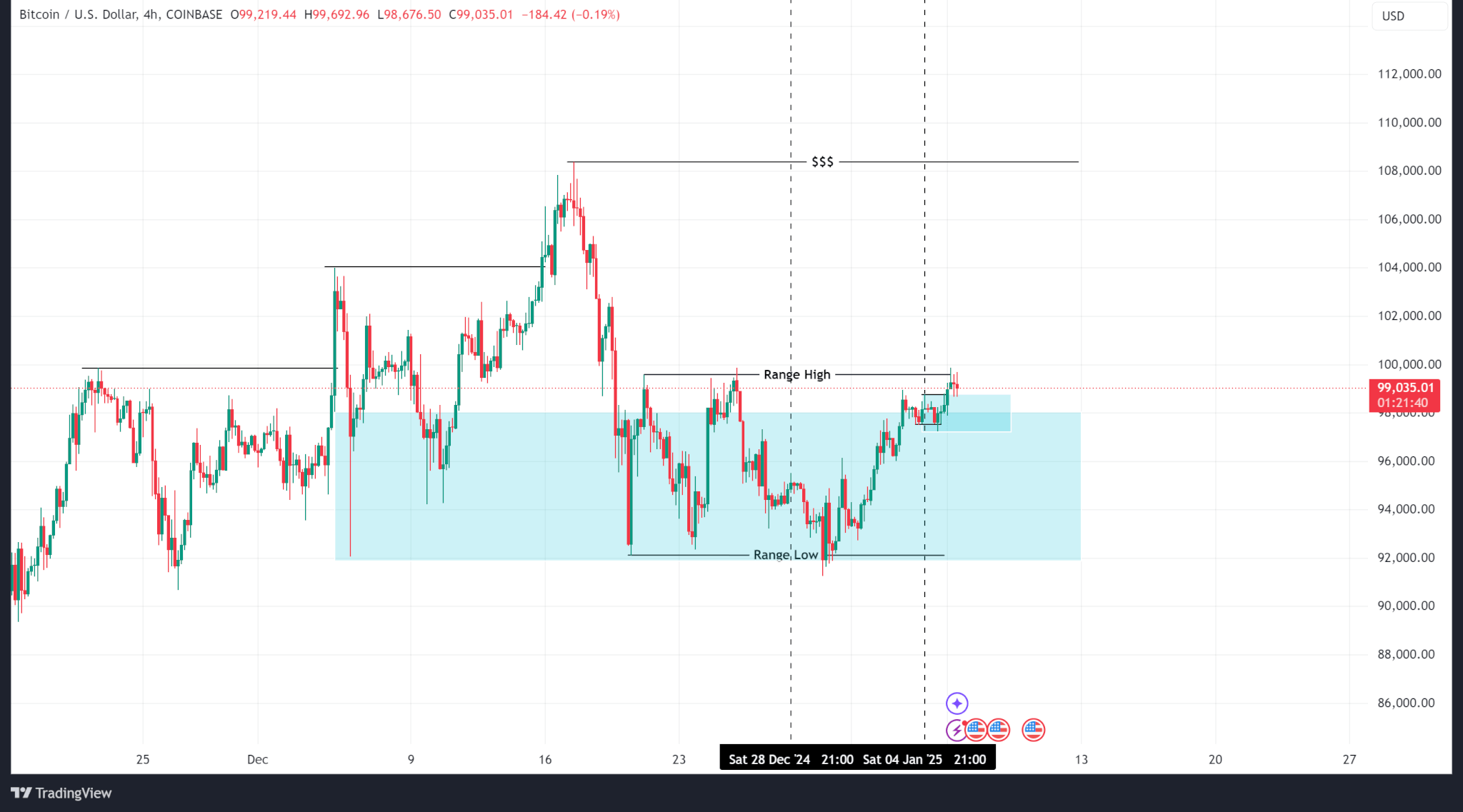

Bitcoin price improved last week, but remained within the range set in the previous trading session. BTC hit a weekly low of $91,271.19 and a weekly high of $98,972.29. Bitcoin closed last week at $98,198.52.

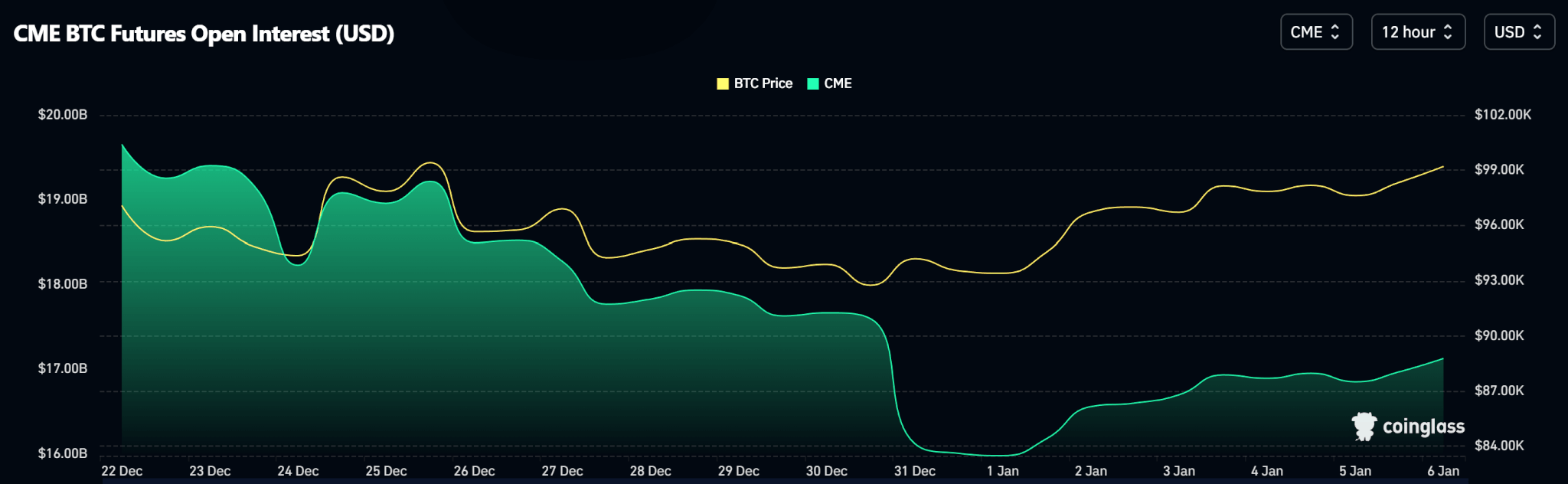

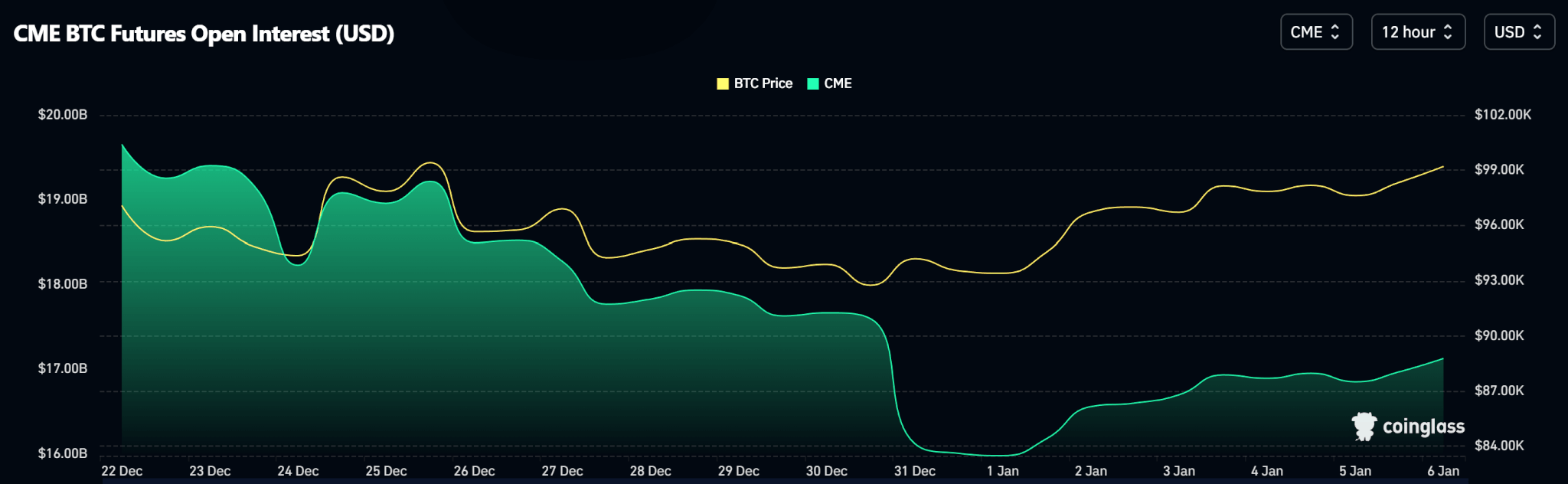

CME’s open interest improved from last week as more contracts were added. Comparing this to the price action shows that longer contracts have been opened.

Meanwhile, BTC ETF flows were net negative next week with total outflows of $652.1 million.

outlook

BTC found support within the demand zone in the second half of the year and started moving higher (supported by new futures longs). BTC first needs to break above the range high of $99,596.57.

At the time of publication, BTC is trading at $101,978.76.

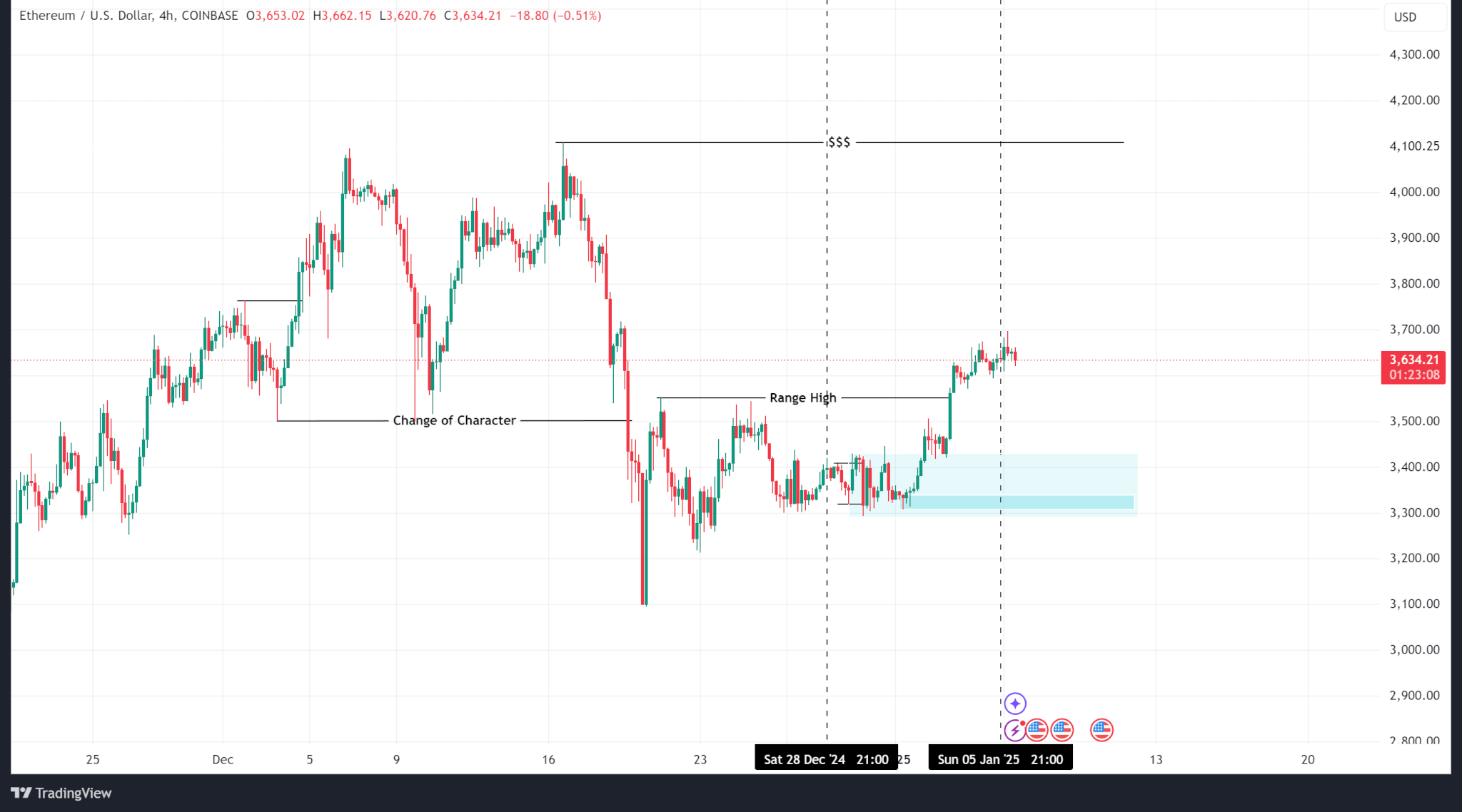

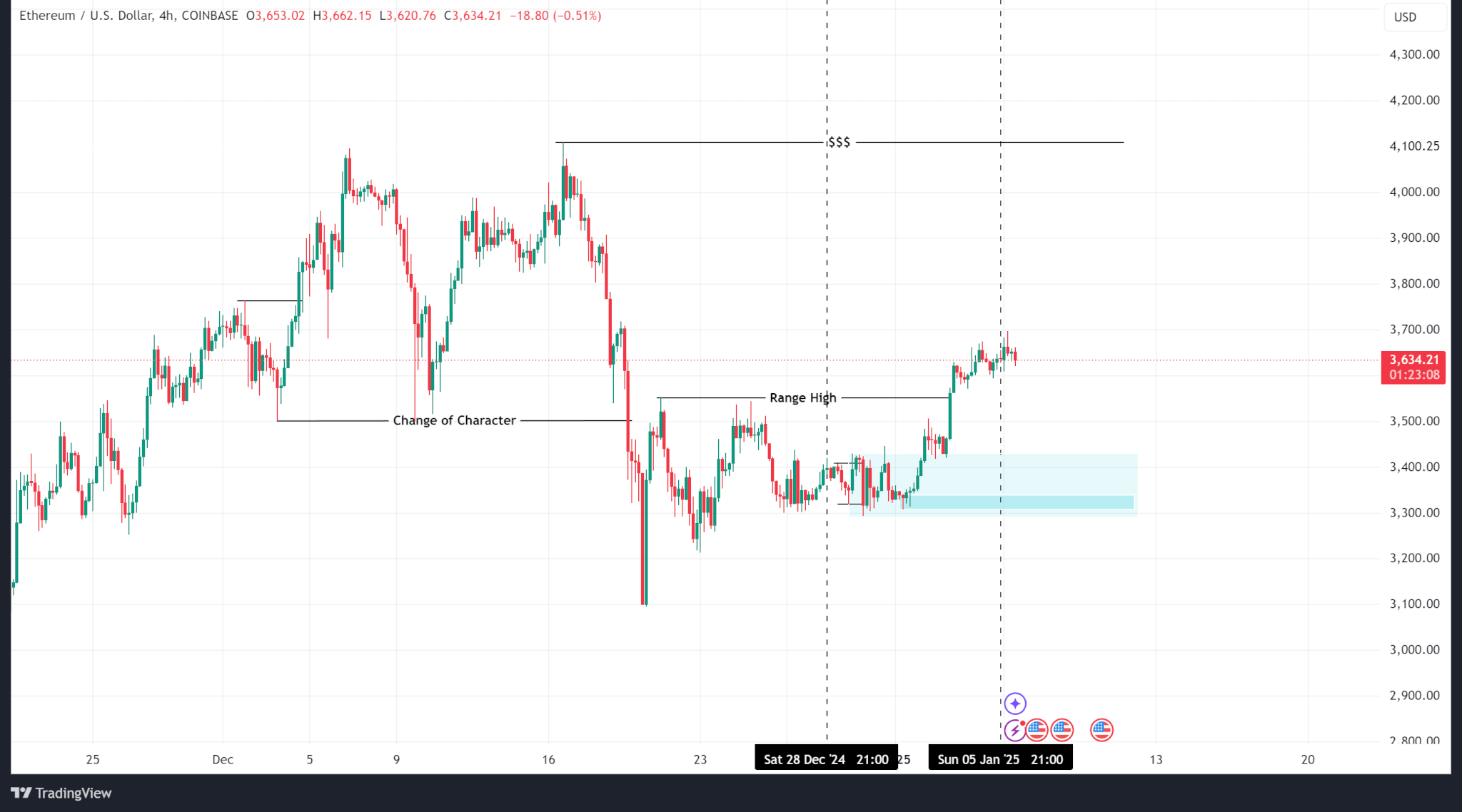

Ethereum

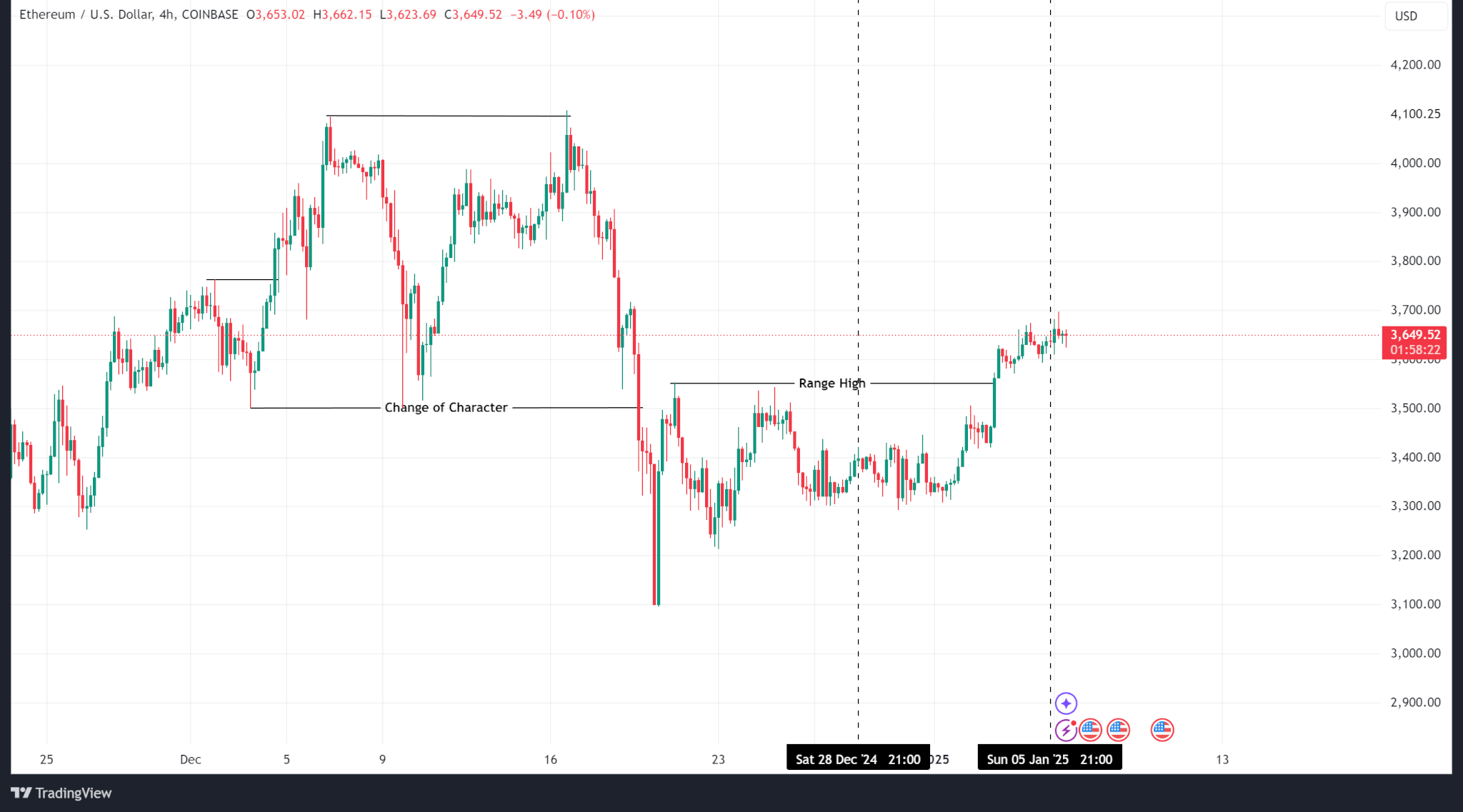

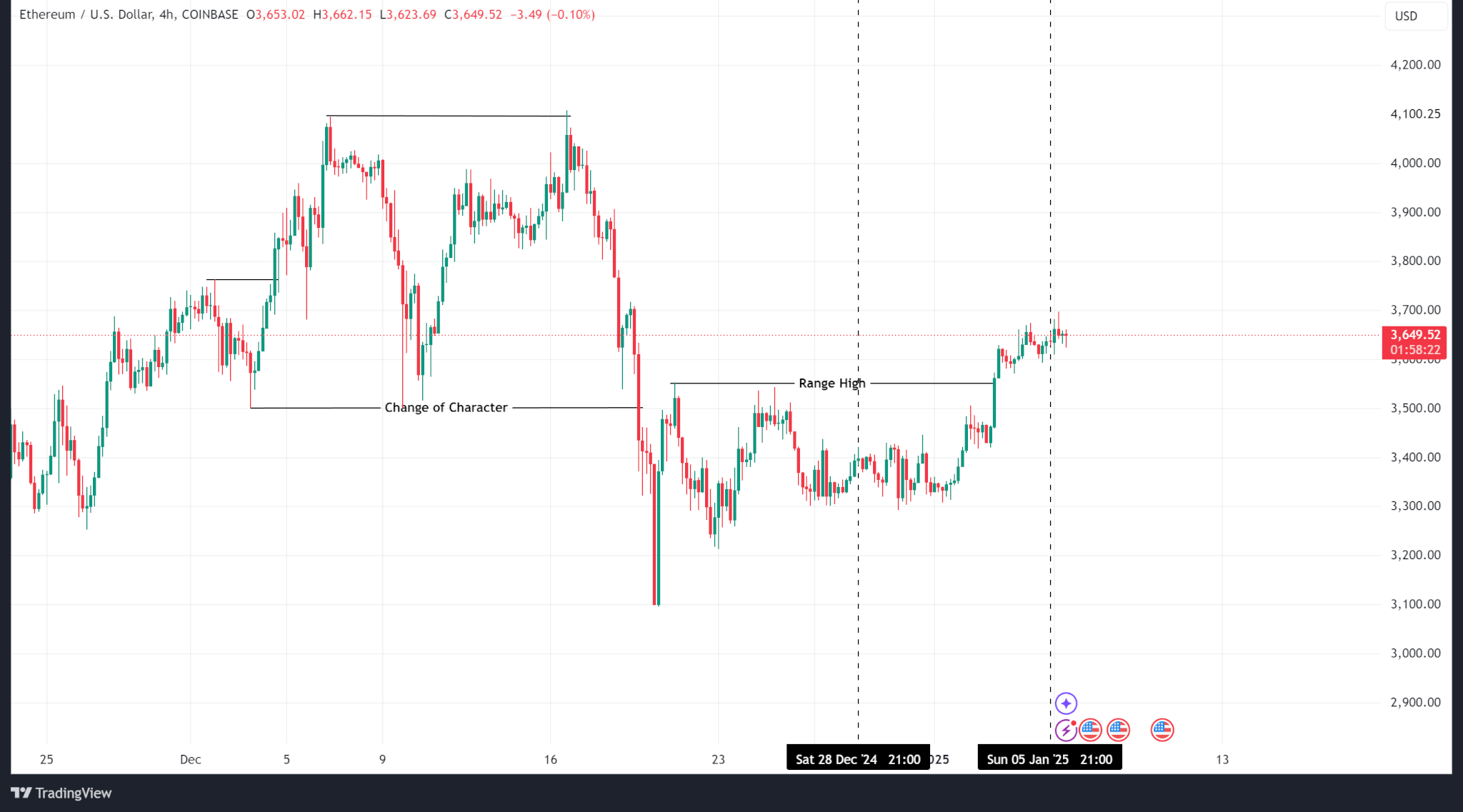

Ethereum’s price trend has become more bullish, breaking above the range formed during the previous week’s trading session. The weekly low and high prices were $3,293.19 and $3,675.77, respectively. ETH ended last week at $3,637.39.

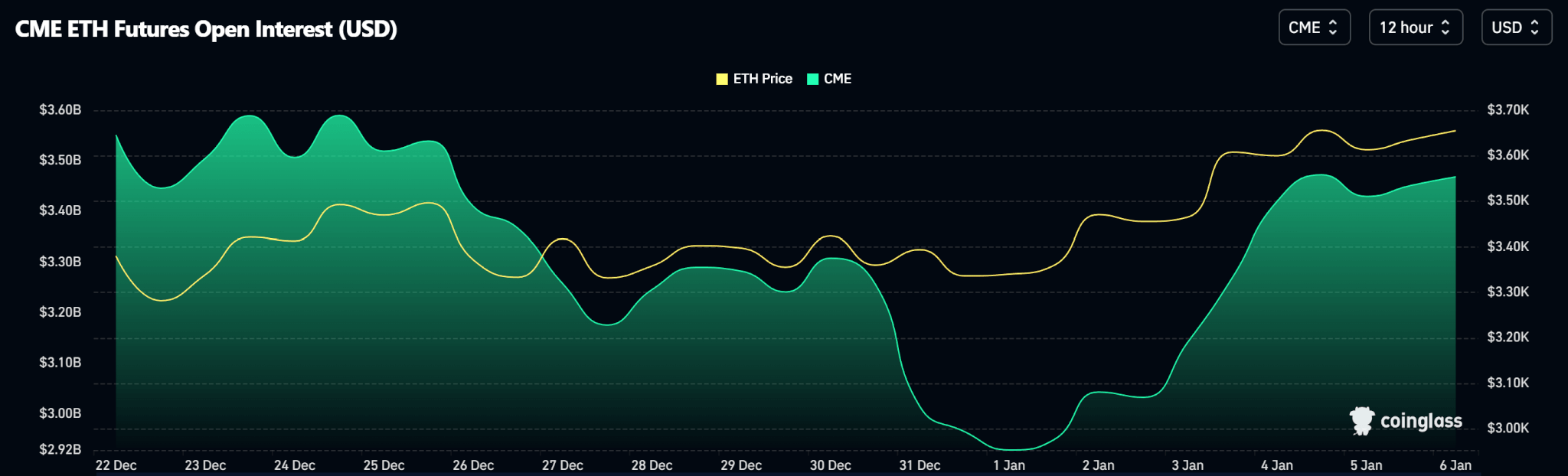

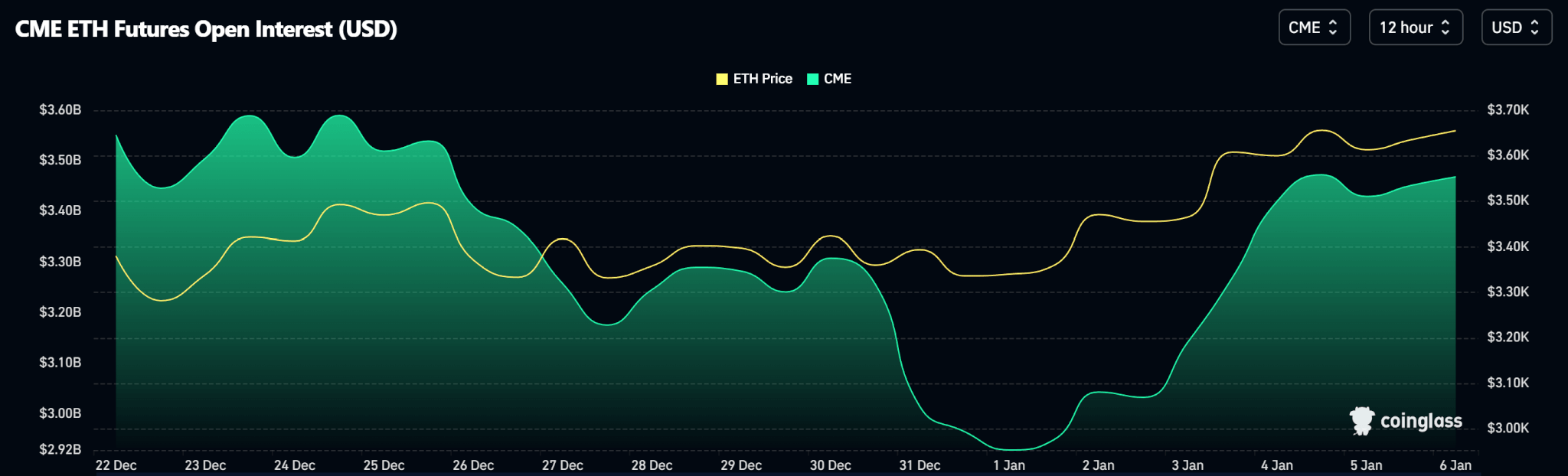

Similar to the Bitcoin open interest chart, Ethereum OI hit a weekly low on January 1st and has since risen as new longs enter the derivatives market.

Meanwhile, $97 million was outflowed from US ETFs, resulting in a negative week for spot ETH ETF inflows.

outlook

Price has broken out of the last range high, but will need to break out of the recent high $4,096.44 level to resume the bullish trend. For the time being, demand levels at the $3,500.00 level are likely to act as upside liquidity.

ETH is trading at $3,679.36 at the time of publication.

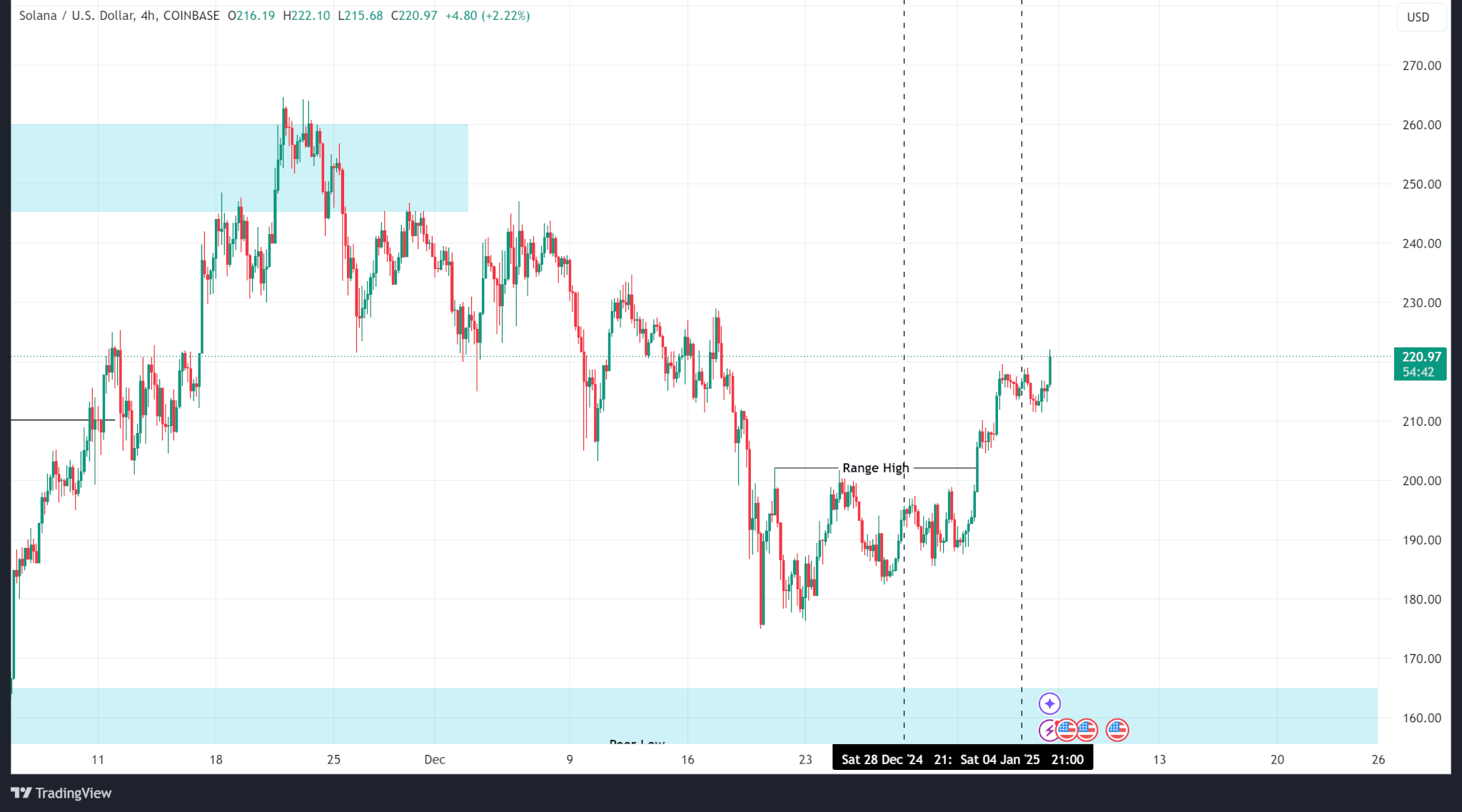

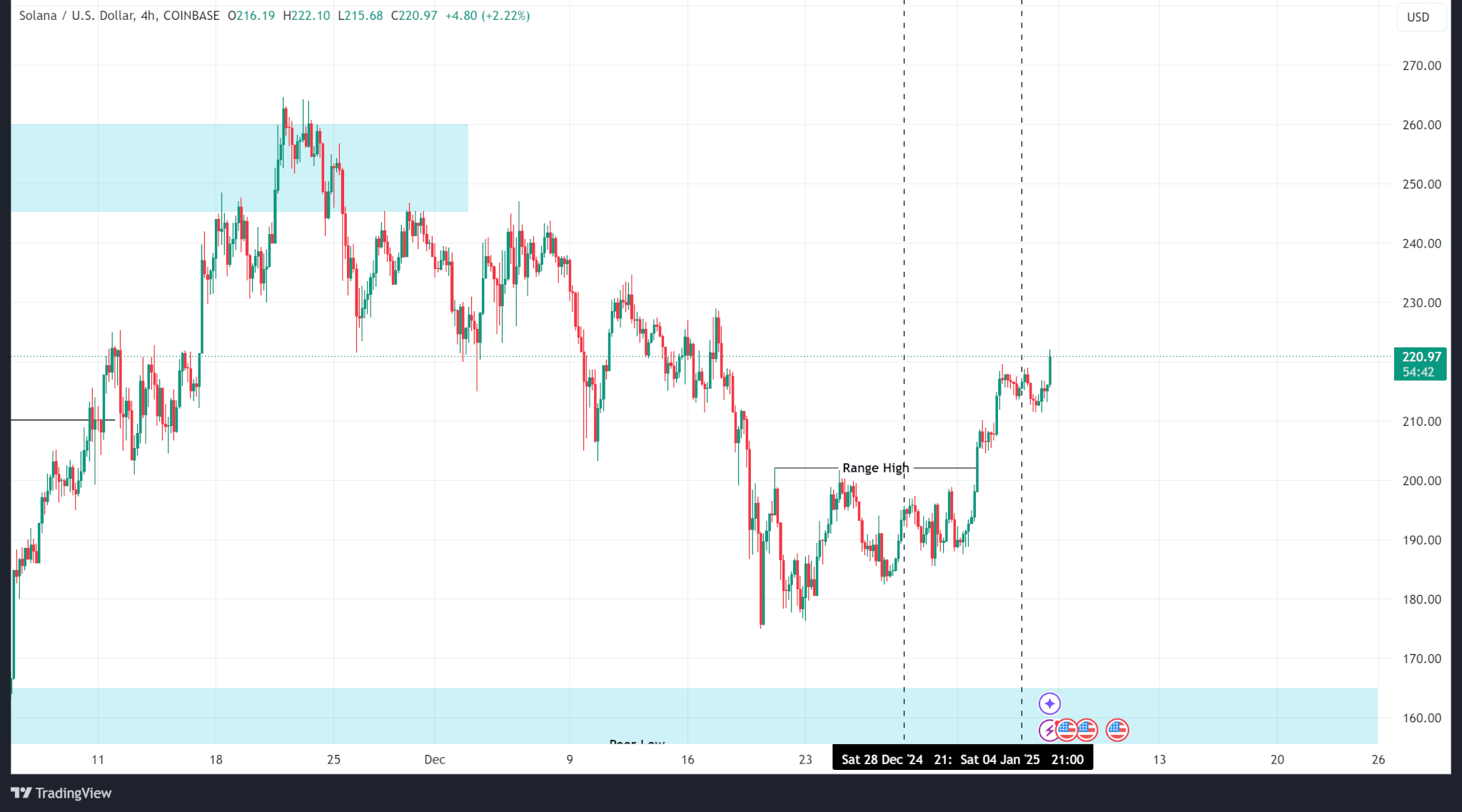

Solana

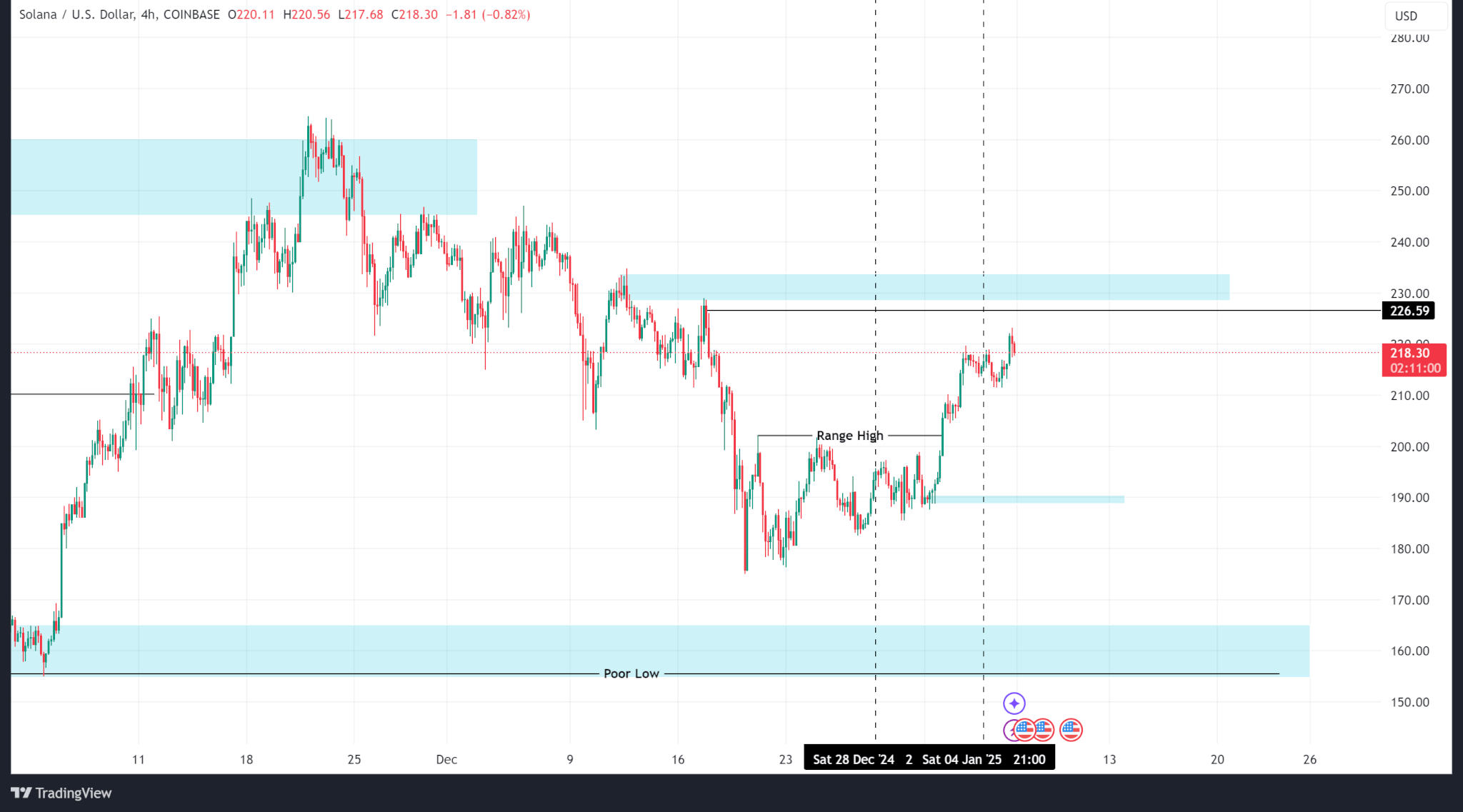

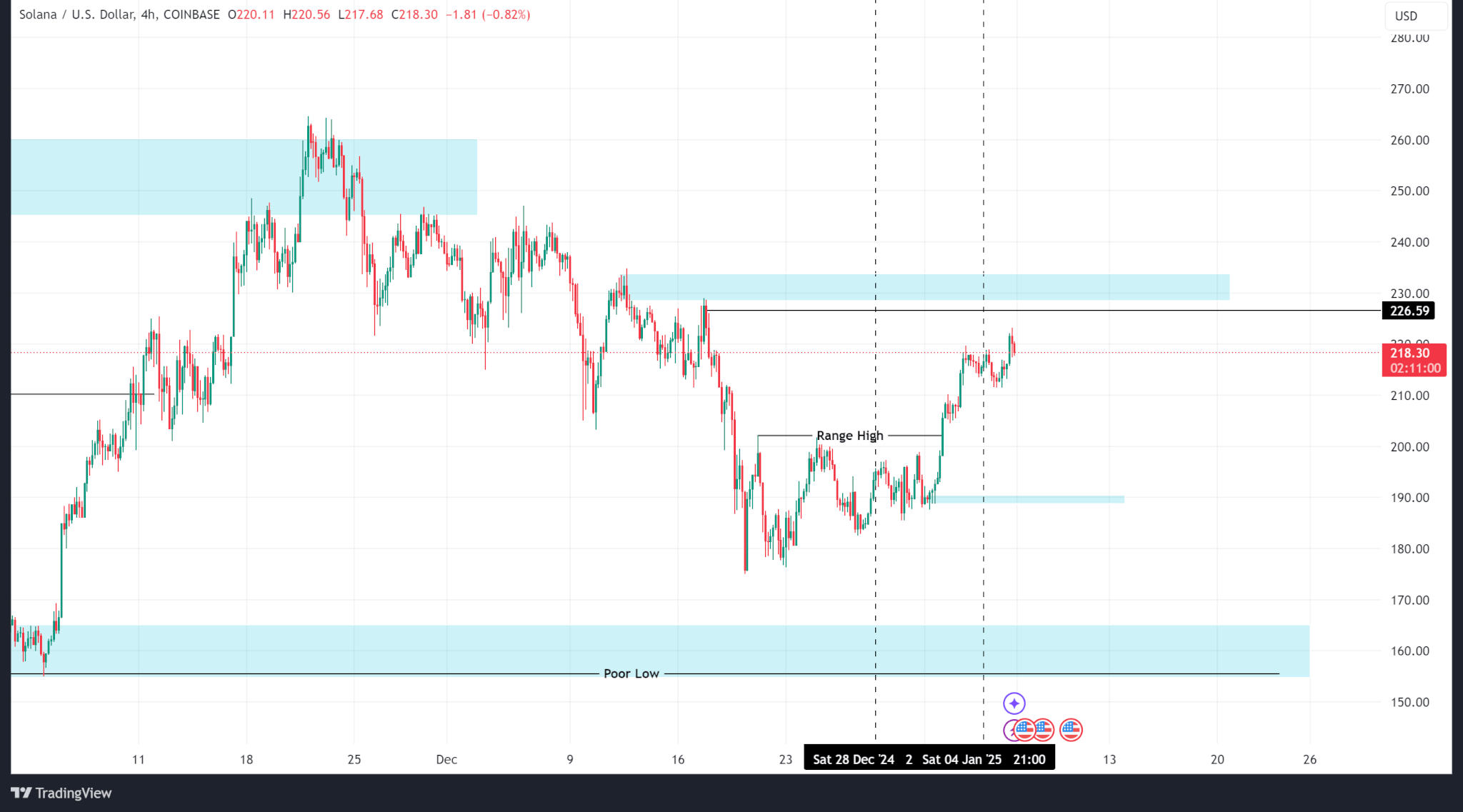

Solana price action last week was bullish, above the local range high of the previous week’s trading session. The weekly low and high prices were $185.55 and $219.67.

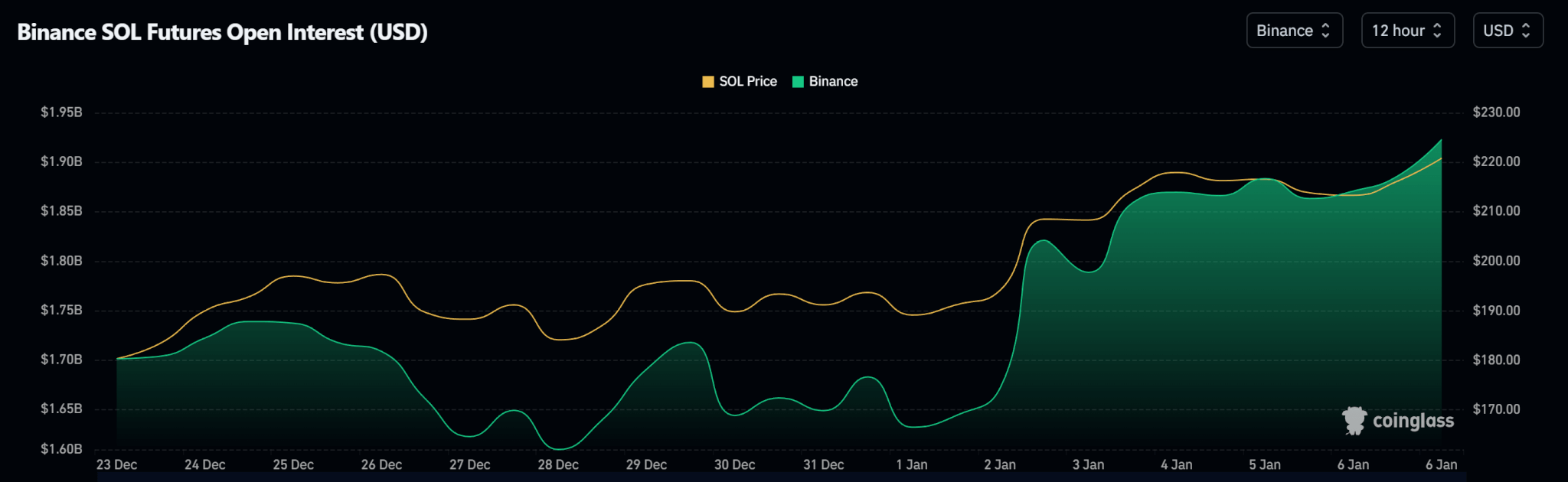

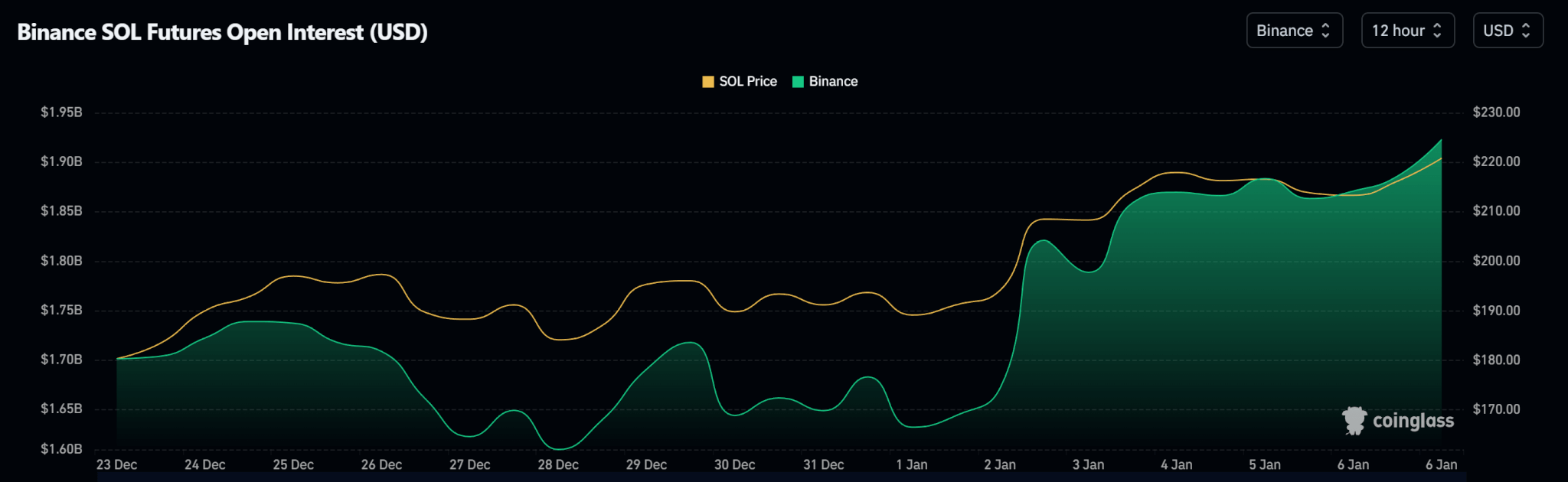

Solana’s open interest has increased since January 1, following a similar pattern to Bitcoin and Ethereum.

outlook

Despite failing to hit a new all-time high, Solana’s trend is bullish. However, the price has hit consecutive lows in the second half of the year and needs to break through the $230 level and then the $260 level to continue the bullish trend.

At the time of publication, SOL is trading at $218.28.

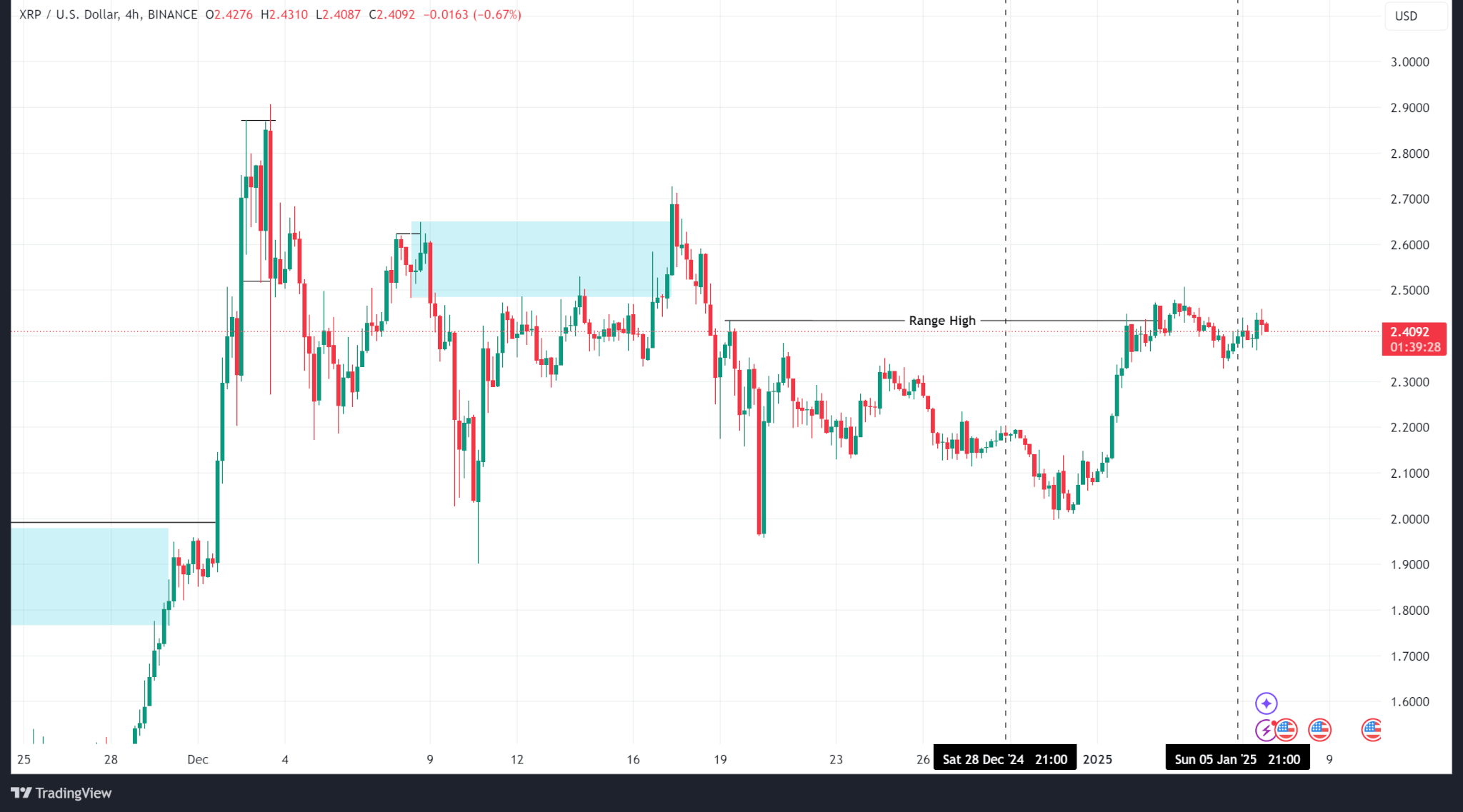

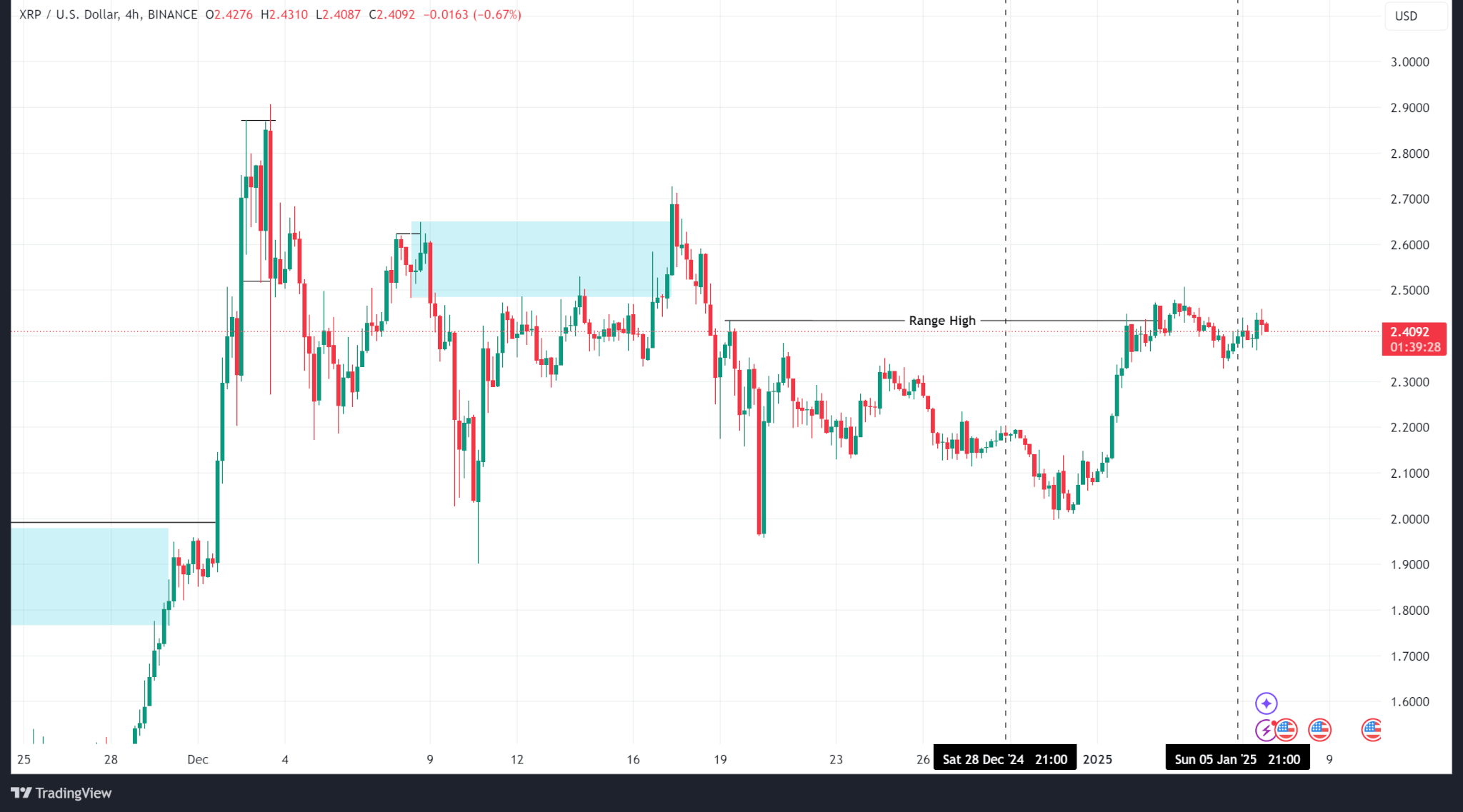

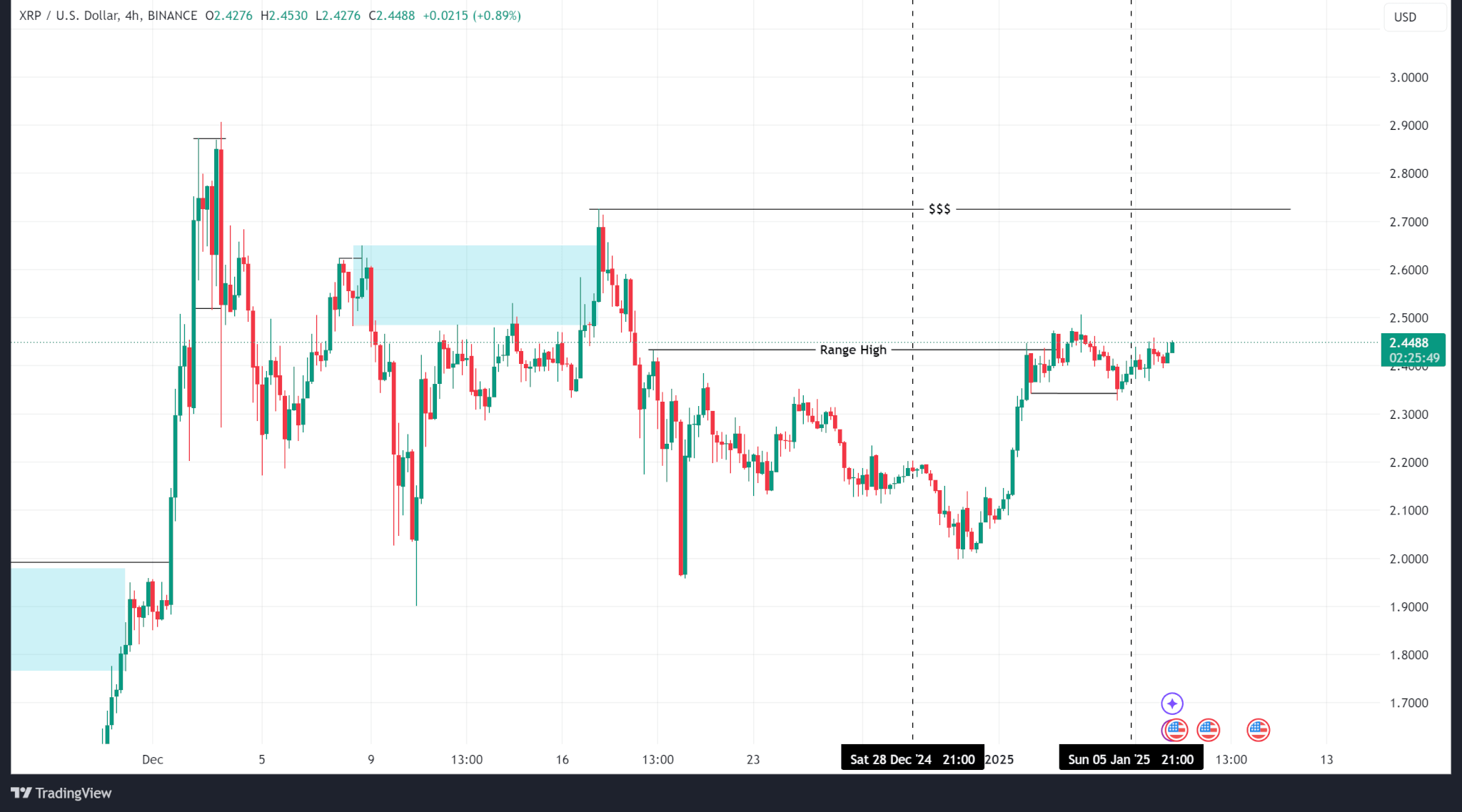

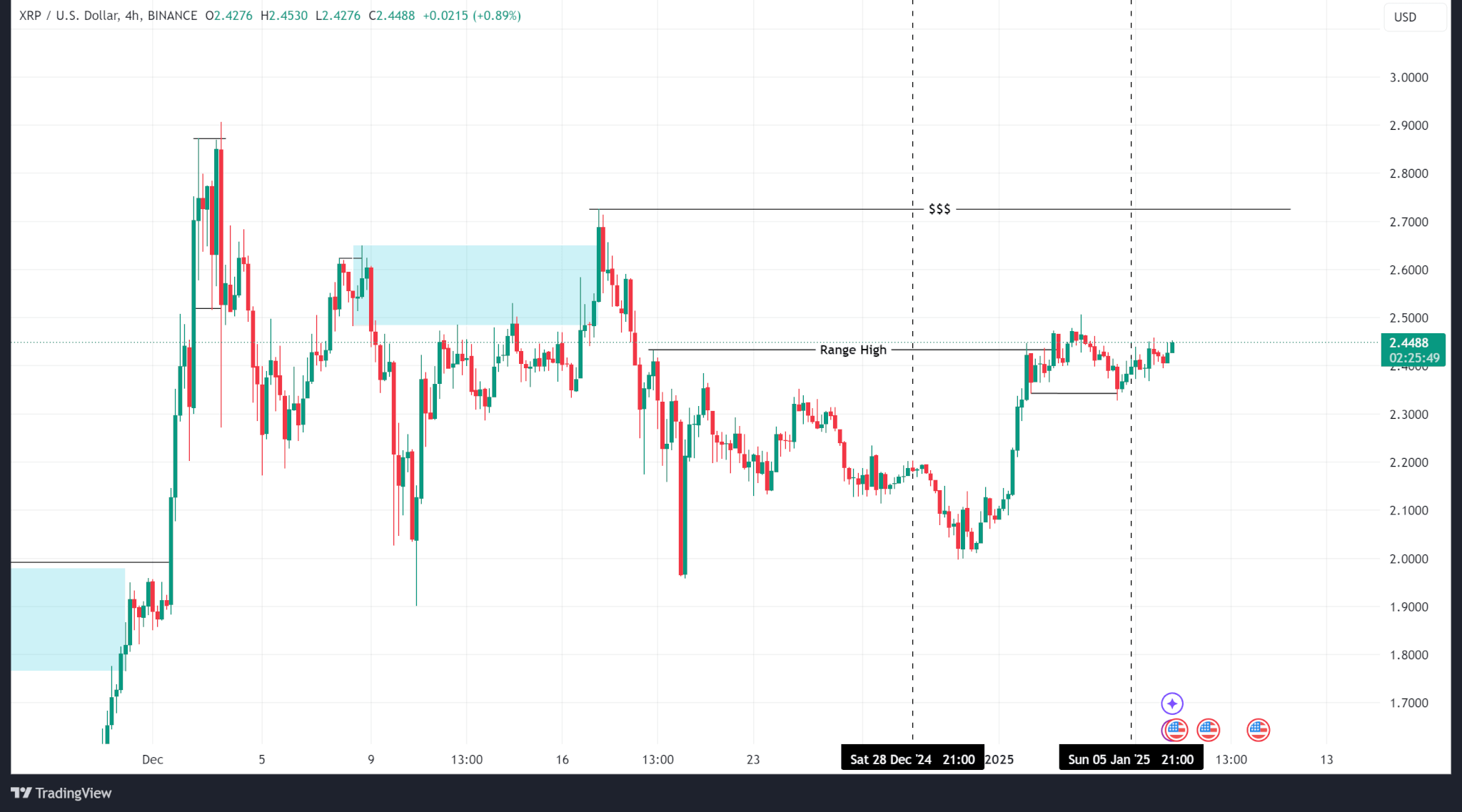

ripple

Ripple’s price action has improved after hitting a low of $1.99 and a high of $2.50 last week.

However, the increase in long-term contracts did not push prices up, and prices did not match open interest.

outlook

Since breaking out of the range high and pulling back for liquidity at the last low of $2.34, XRP price has recorded higher highs and lower lows, climbing toward the next supply zone near $2.72.

XRP is trading at $2.44 at the time of publication.